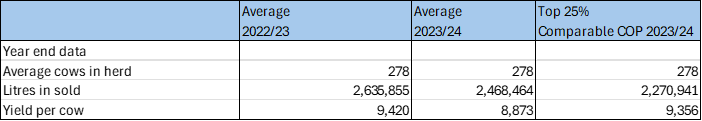

We have completed our annual review of the cost of production for clients with March and April year ends. Given the massive reductions in milk price this year, and the squeeze this has had on profits,there has never been a more important time to have a thorough understanding of your costs so you can plan ahead.

The data used is collated from both long-standing clients, newer clients that we have started working with over the last 12 months, and clients we have been referred to from bank business support teams.

This newsletter presents our Average and Top 25% Cost of Production (COP) figures for bench marking purposes.

As expected, there is a wide range of total cost of production from 38.56 – 59.37ppl.

By drilling down into individual costs, you can compare your business against the benchmark and see where there may be scope to investigate where things can be tightened up within your own business.

The data used is for conventional milk production only, and from black and white herds.

Notes:

BPS and non-dairy enterprise income is excluded.

Overheads include private drawings.

Comparable farm profit should not be used to judge robustness or the ability of a business to service debt.

Comparable farm profit and cost of production is a bench marking tool only.

The scale of enterprises cannot be compared year to year as they deal with different farm samples.

Differences year to year on a pence per litre basis are more meaningful.

The population making up the average not the same year to year.

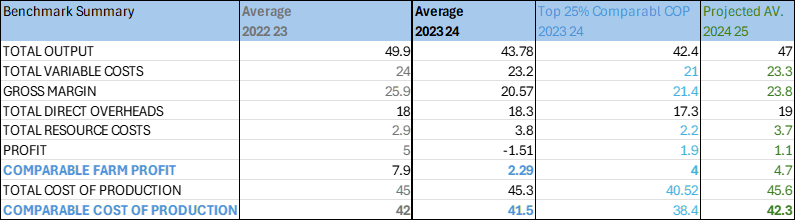

Key Cost / Price Analysis: 2024 vs 2023-year ends

Milk: Milk price fell by 7.58ppl or 17% as the Ukraine/Covid shock subsided

Variable costs: Variable costs fell over the year, principally feed and fertiliser costs.

Whilst welcome, this did not offset the price milk fall.

Other costs remained firm, with inflation baked in.

Gross Margin: The cost/price squeeze hit margins significantly,reducing gross margin by 4.5p.

Overhead costs: Overheads per litre remaining constant, however staff costs

have risen significantly.

Comparable Costs of production: This figure excludes rent and finance costs in this sample was 41, practically the same as in 22-23

Comparable Farm Profit: Calculated at 2-29 ppl, down 5-6p from the previous year

Outlook for 2024 25…

Overall we view the coming year with a good deal of optimism, but things are still very tight.

Milk: Milk price expected to rise further. Forward projections (AHBD) 2ppl

Dec. 3ppl over year on average is built in to our model.

Variable costs: Inflationary pressure are still present. We have built in 6% in to our

model on all costs except feed, which expected to ease by 1ppl. Price

reduction tempered by forage quality issues.

Gross Margin: Gross margin expected to increase by 3.3ppl, drive by output primarily.

Overhead costs: 6% inflationary increase is built in except for electricity. New contracts down considerably on those prevailing in the last 2 years.

Comparable Costs of Production: This figure excludes rent and finance costs in this sample 42.3ppl, up 0.8ppl from previous year.

Comparable Farm Profit: Calculated at 4.7 ppl, an increase of 2.5ppl or 57% over 23 24 result.

If you would like more information call us for a fresh perspective on how to deal with the challenges and opportunities dairying is facing on 01666 817278.