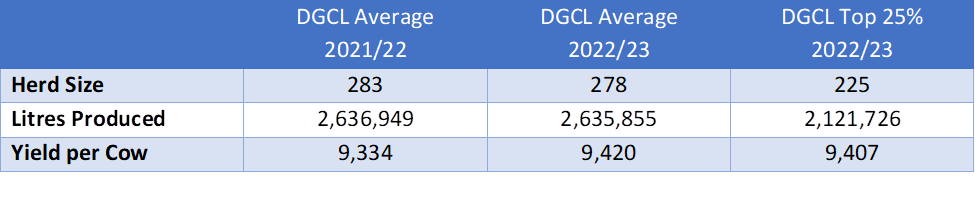

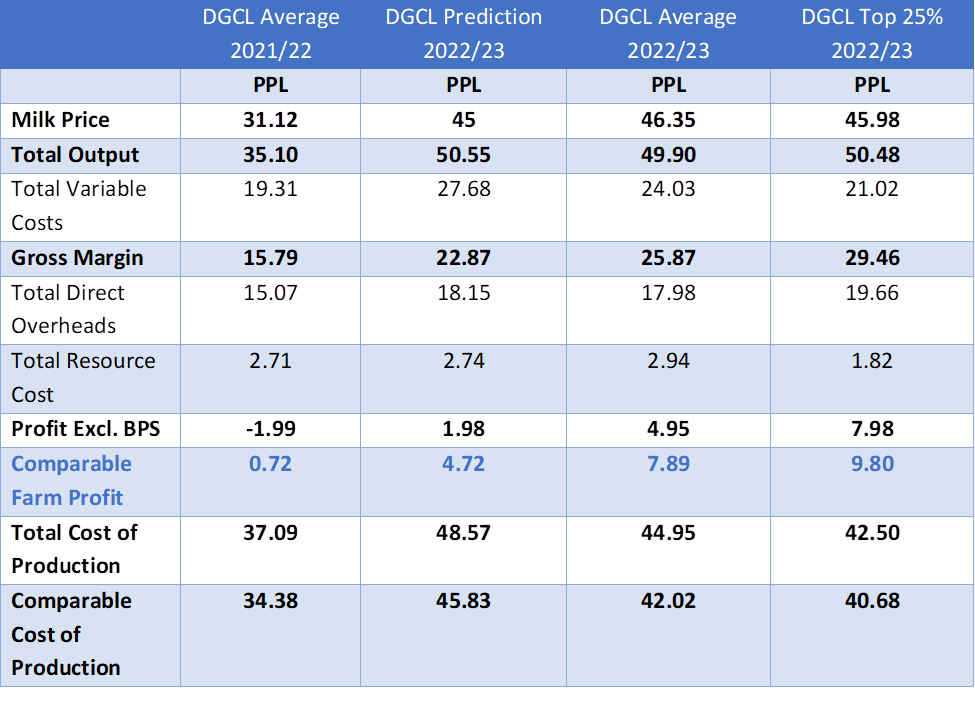

We have completed our annual review of the cost of production for clients with March and April year ends. Given the massive inflation in costs, there have never been a more important time to have a thorough understanding of these costs, so you can plan ahead.

The data used is collated from both long-standing clients and newer clients that we have started working with over the last 12 months.

This newsletter presents our Average and Top 25% Cost of Production (COP) figures for benchmarking purposes.

As expected, there is a wide range of total cost of production from 32.05 – 51.36ppl.

By drilling down into individual costs, you can compare your business against the benchmark and see where there maybe scope to investigate where things can be tightened up within your own business.

The data used is for conventional milk production only.

The scale of enterprises cannot be compared year to year as they deal with different farm samples.

Notes

BPS and non-dairy enterprise income is excluded.

Overheads include private drawings.

Comparable farm profit should not be used to judge robustness or the ability of a business to service debt.

Comparable farm profit and cost of production is a benchmarking tool only.

The scale of enterprises cannot be compared year to year as they deal with different farm samples.

Differences year to year on a pence per litre basis are more meaningful.

Key cost analysis:

-

DGCL prediction is the prediction we made at the 2022 dairy show: People achieved lower variable costs than we feared they might.

-

The average milk price increased by 15.23ppl or 49%, whilst total costs rose by 27% over the same year.

-

The total output includes milk sales, culls, calf sales and changes in valuations. BPS and non-dairy incomes are excluded. The average total output has increased by 14.35ppl, with a range between 48.72 – 54.25ppl. This is mainly driven by the increases in milk price and strong cull values.

- Feed spend has risen by 3.34ppl with in the year, which was expected to with the changes with the feed market. Forage quality and excellence in grazing are key drivers for lower feed cost and increased profits.

-

Vet & Med costs have increased marginally by 0.16ppl. All farmers should look at their vet costs on a per cow basis and identify the health areas which are causing the main issues and work with your consultant/vet to reduce them.

- Light and Heat spend has only increased by 0.20ppl, with a large proportion of clients still in lower p/kwh contracts. There will likely be a rise within the current financial year.

-

Total spend on labour, which includes personal drawings has increased by 0.16ppl. Those with the lower staff costs are those reliant on family staff receiving low levels of drawings, but receiving other significant benefits (house, vehicles etc).

-

Total spend on power & machinery is a key area of overhead spend, this includes contractors, machinery repairs, fuel/oil and machinery depreciation. Within the last year, this risen from 6.86ppl to 8.14ppl, which is a 19% increase.

-

The Average Farm Profit achieved across the sample was 4.95ppl, with a Comparable Farm Profit (CFP) average of 7.89ppl.

- The top 25% made a CFP of 9.80ppl from the same output, reflecting a high degree of cost control, confirming that cost is the key driver of profit for most, and is the thing farmers should focus on.

Looking forward to this year there will be a tighter squeeze on profit margins with the decreases in milk prices already taking effect.

Key areas of focus on for efficiencies:

- Efficiency of production – there is a big difference in profitability of the top and bottom performers in terms of milk quality and cow fertility in particular.

- Look very closely at feed costs and whether they can be cheapened in any way without affecting cow performance (marginal litres or cows may not be cost effective at current feed prices!).

- Maximise milk from forage – both silage and grazing quality.

- Look at other costs and see if there is scope to reduce them without impacting negatively on the business.